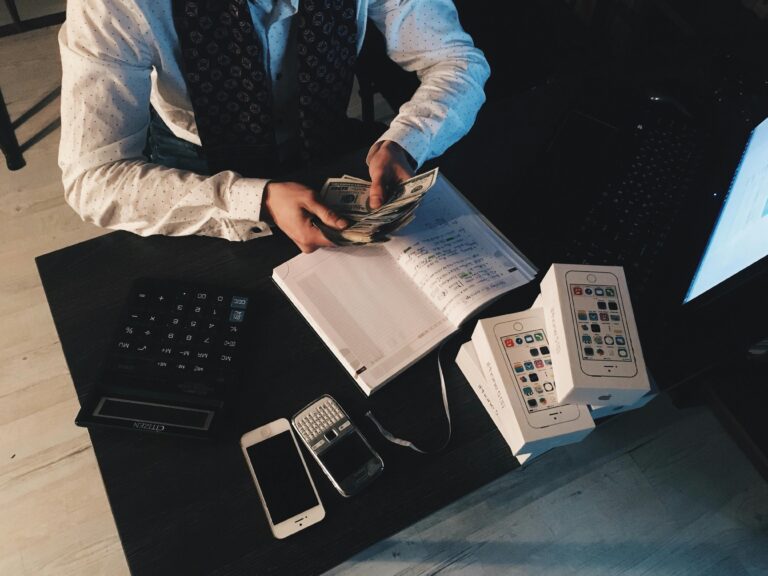

Xyphina Tornhanna - discapitalied Founder

Born in Waltham’s Complex Financial Environment

Waltham’s unpredictable economic climate has shaped Xyphina’s disciplined, measured approach to capital markets and investment management. Surrounded by fluctuating trends and evolving market pressures, she learned early that stability requires realism—not optimism.

This philosophy is shared across the team, including founder Xyphina Tornhanna and authors Wandaneliah Kilgore and Stephaniela Jamersonsil, each contributing their own insights and analytical rigor to strengthen this guiding vision.

DIS Capitalied Reality Console

A unified tool to stress-test your financial ideas with realism, caution, and disciplined thinking.

Weak

Balanced

Reality Check Overview

Use the left panel to enter your financial idea. The Reality Console will evaluate:

- Resilience under uncertainty

- Evidence strength

- Risk alignment

- Practical realism

Your full analysis will appear here.

What the Hub Offers

Access to early-stage testing of finance-related software and strategies.

Insight into emerging investment techniques and their practical limitations.

Opportunities to participate in discussions highlighting the risks and challenges of novel financial tools.

Finance Beta Testing Hub

Rooted in the mission detailed on our Our Mission page and led by the leadership outlined on the DISCapitalied Founder page, this hub provides cautious exploration rather than definitive solutions.

Blog Posts

How Recent Interest Rate Hikes Impact Capital Markets Movement

The Fed’s Moves and Why They Matter The past twelve months have seen a steady drumbeat of rate hikes from the Federal Reserve, with the ...

Read More →

Family Wealth Transfers: How To Plan for Generational Impact

Why Generational Wealth Planning Matters There’s a saying in wealth circles: “Shirtsleeves to shirtsleeves in three generations.” It’s not just a cliché it’s a documented ...

Read More →

Sector Rotation Strategies To Capture The Next Big Bull Run

What Sector Rotation Really Means At its heart, sector rotation is a simple idea: move your investments where the growth is likely to happen next. ...

Read More →

Top Diversification Techniques To Shield Your Portfolio from Risk

Why Diversification Isn’t Optional Anymore The days of a calm, predictable market are over. Volatility isn’t an outlier anymore it’s the baseline. Whether it’s inflation ...

Read More →

Credit Score Secrets: 5 Habits That Improve Your Rating Fast

Pay Everything On Time No Exceptions Your payment history makes up the biggest chunk of your credit score about 35%. That means whether or not ...

Read More →

How Dollar-Cost Averaging Can Boost Long-Term Investment Returns

The Basics in Plain Terms Dollar cost averaging, or DCA, is a simple investing strategy that sounds more complicated than it is. Instead of putting ...

Read More →

Top Asset Allocation Models For Long-Term Wealth Protection

Why Asset Allocation Outweighs Stock Picking Forget chasing the next big stock. Wealth that lasts isn’t built on high stakes bets it’s structured through discipline ...

Read More →

Decoding Capital Markets Volatility During Economic Downturns

What Drives Market Volatility in a Recession When markets enter a downturn, investor behavior tends to get primal. Fear takes over reason. Selling pressure escalates, ...

Read More →

Capital Flow Trends: Where Global Investments Are Headed in 2026

Shifting Global Priorities Global investment trends are being redrawn by a few heavyweight forces. Deglobalization is stripping out the old assumptions cheap labor abroad, endless ...

Read More →

Tax-Efficient Investment Choices For High-Net-Worth Individuals

Why Tax Efficiency Should Be on Your Radar For high net worth investors, taxes aren’t just a footnote they’re often the biggest drag on long ...

Read More →